Author: David Thurlow

Chartered Financial Planner and Investment Manager - Member of the Investment Committee

View profile

Published: December 2025

The Autumn Budget 2025 brings important updates that could affect how you save, invest, and plan for retirement. While the changes are less dramatic than last year’s Autumn Budget, they still require careful consideration to keep your financial strategy on track.

Two of the most notable areas are salary sacrifice pension arrangements and ISA allowances. Below, we break down what has changed and what the real‑world impact looks like across different income levels.

Salary Sacrifice: What’s Changing and How It Affects Your Pension

What is the current position?

Under the current rules, pension contributions made via salary sacrifice benefitted from full income tax relief and National Insurance Contributions (NIC) savings on the sacrificed amount. This made salary sacrifice one of the most attractive ways to boost pension funding.

What has changed in the Autumn Budget 2025?

From April 2029 onwards:

- NIC applies to employee contributions that are salary sacrificed on amounts above £2,000 per year.

- The starting rate of employee NIC rate applied is 8% (basic rate) on the excess.

- Employers are also required to pay NIC 15% on sacrificed amounts above the £2,000 threshold.

This means salary sacrifice remains beneficial, but it is no longer entirely NIC‑free for anyone contributing more than £2,000.

The impact by income level

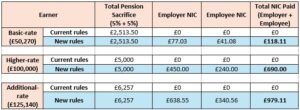

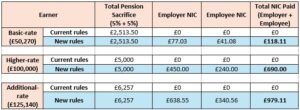

Below is the impact per tax-threshold, where all assumes 5% employee and 5% employer salary sacrifice arrangement is in place:

If you’re a higher-rate or additional rate taxpayer, these NIC changes could reduce the efficiency of salary sacrifice.

Key takeaway on salary sacrifice

Salary sacrifice remains highly beneficial until April 2029, but is less so after that date especially for higher earners. Reviewing your contribution levels and strategies is increasingly important in this period where you can achieve maximum relief before the legislation is implemented in April 2029.

ISA Allowance Changes: What Savers Need to Know

The Autumn Budget 2025 also introduced changes to ISA allowances from April 2027, with a clear distinction based on age.

Under 65s

- Stocks & Shares ISA allowance: £20,000

- Cash ISA allowance: £12,000

This limits how much younger savers can shelter in cash ISAs, which the Chancellor hopes will mean encouraging longer‑term investment through stocks and shares.

For over 65s, the cash ISA allowance remains at £20,000 supporting lower-risk strategies retirees and those approaching later‑life income needs. The Stocks and Shares Allowance also remains at £20,000.

Final Thoughts

The Autumn Budget 2025 has presented reasons and opportunities to maximise allowances before they are reduced before April 2027 and 2029.

Salary sacrifice pension contributions are particularly valuable until April 2029, while ISA changes create a distinction between growth‑focused and capital‑preservation strategies.

It is clear that the government is prepared to target ISA allowances, and it is worth considering maximising these where possible and appropriate to protect against possible future changes.

Now is a good time to review your financial planning, ensuring your pension and ISA strategies still align with your circumstances and objectives.

We are always here to help you with any questions or concerns you may have. If you would like to talk to one of our Chartered Financial Planners, please contact us on 01223 233331 or email info@mmwealth.co.uk.

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. This article is for general information only and does not constitute advice. All contents are based on our understanding of current taxation and legislation, which is subject to change.

The value of investments and the income from them can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance.

The information in this article is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.

The Financial Conduct Authority does not regulate estate planning and tax planning.