Cashflow modelling

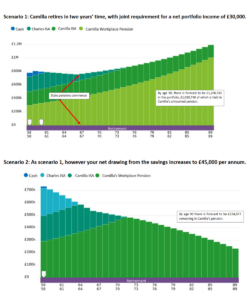

Our financial planners use cashflow modelling to help you answer important questions about your life.

- Can I afford to maintain my desired lifestyle in retirement?

- Can I afford to assist my children / grandchildren financially?

- Am I going to leave behind an Inheritance Tax bill?

- How can I take an income in the most tax-efficient way possible?

- Is my family financially protected if I die early or suffer a serious illness?

- Financial splitting of assets e.g. divorce.

Our financial planners will guide you as you weave your way through the complexities of life, helping you predict and adapt to the challenges, changes and events throughout your journey.