Author: Gary King

Chartered Financial Planner

View profile

Published: November 2022

The key to achieving your lifetime financial goals is to put in place a robust financial plan whilst you are young and keeping it under regular review.

Cashflow modelling, combined with regulated financial planning advice, can greatly increase the probability of you achieving your lifetime financial goals, whatever they may be.

Cashflow modelling collates all your financial information (assets, liabilities, income and expenditure) and then combines this with your lifetime financial goals, such as assisting children with education costs or onto the property ladder, paying off your mortgage early and ultimately retirement.

This creates a scenario which is presented in an easy to understand format, bringing to life what your financial future will look like, or could look like, with some changes that can be identified and quantified.

Cashflow modelling can also help identify the risks which may prevent or delay some of your financial goals being achieved.

These include;

- ill health,

- loss of employment,

- death of a loved one,

- investments falling in value,

- living costs rising,

- or changes in taxation.

Many of these risks can be managed once identified, for example by way of establishing suitable protection arrangements to cover a shortfall is life or income protection cover.

In our experience, there are very few people who would not benefit from some level of cashflow modelling.

Do I need existing wealth in place to benefit from cashflow modelling?

No, you don’t need to have significant assets in place to want to understand whether you can achieve your goals. Some of the most common and important questions individuals have that can be answered through cashflow modelling don’t depend on existing wealth:

- Can I afford to pay for my children’s private education?

- Can I assist my children onto the property ladder?

- How much more money do I need to save and for how long?

- How do I make best use of my various tax allowances?

- Shall we invest more in our pensions or ISAs, or pay off the mortgage?

- How much investment risk do I need to take?

- If investment markets were to fall suddenly, how would this impact on my goals?

- Would my family be sufficiently provided for in the event of my inability to work for a prolonged period or premature death?

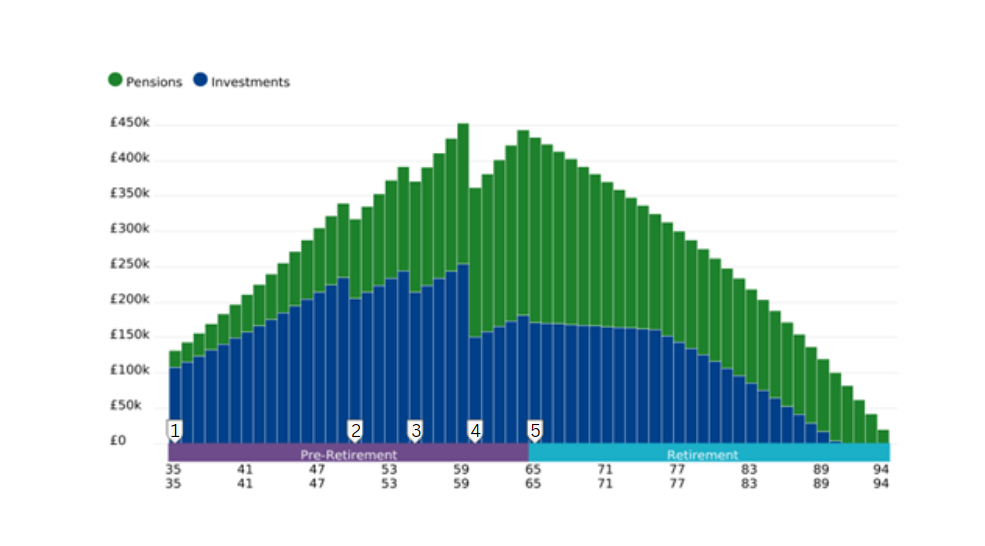

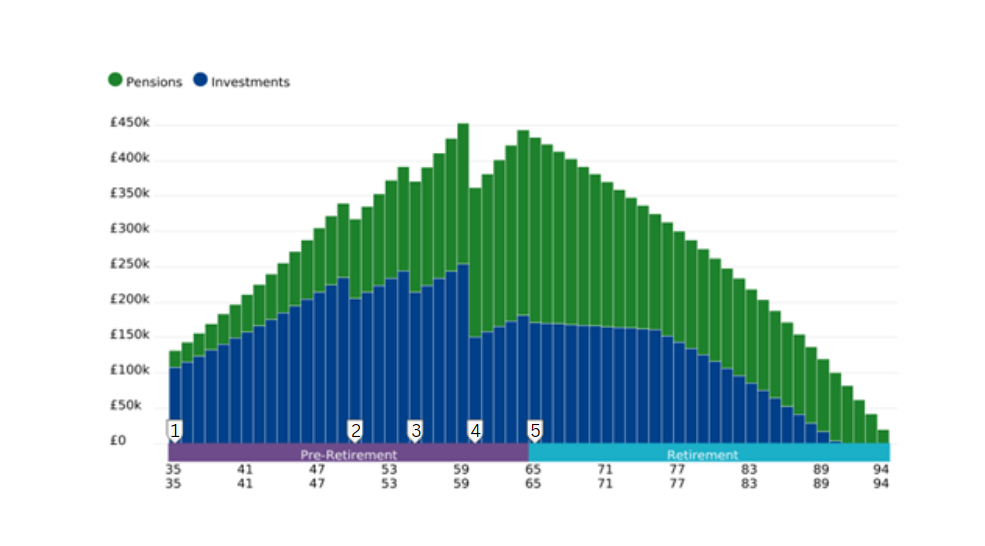

Client scenario

Paul and Sarah are 35 years old and have two daughters, Isabelle age 10 and Lucy age 5. They wish to understand how much they need to save to achieve their key financial goals; namely:

- Gifting Isabelle and Lucy £25,000 each at age 25, to assist them onto the property ladder.

- Repaying their mortgage prior to retirement, ideally by age 60.

- Achieve financial independence at age 65, thereby having the flexibility to fully retire at this point should they wish.

A cashflow model is prepared: –

- Additional savings commence

- Gift to Isabelle

- Gift to Lucy

- Repayment of mortgage

- Retirement

The cashflow modelling enabled us to identify how much Paul and Sarah would likely need to save each year through to age 65. It also enabled us to identify how their surplus income should be allocated across pension and non-pension investments, to maximise tax efficiency and ensure accessibility when their planned capital needs arise.

Contact Gary King on 01223 233331 for independent financial planning and cashflow management advice.

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

The information in this article is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.