Following the changes announced in the October 2024 Budget, we have been supporting our clients in understanding the true implications on how their tax liability could be impacted.

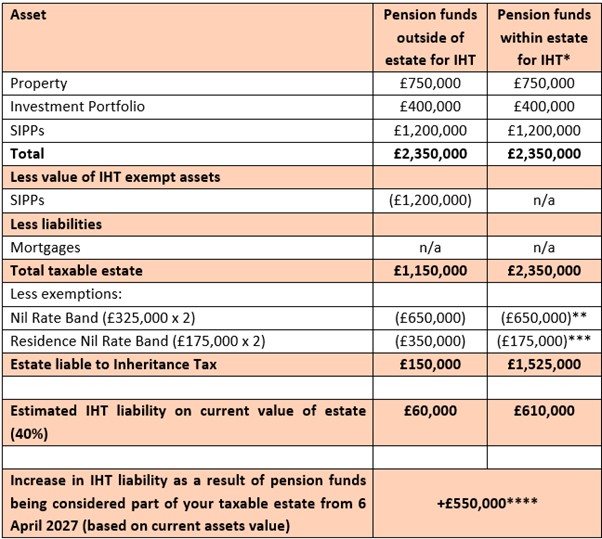

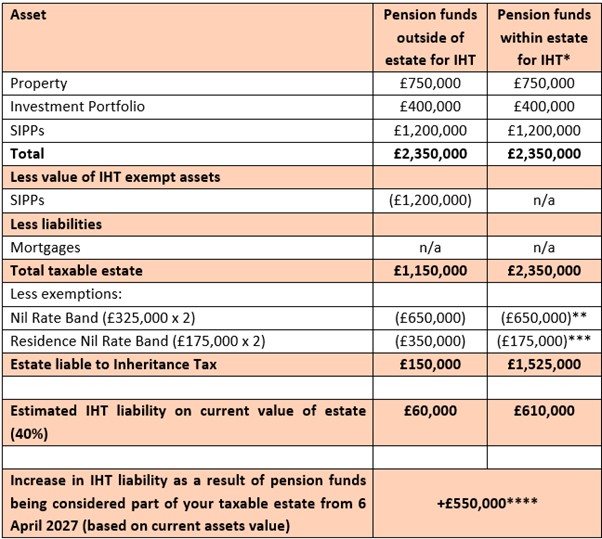

We recently met with a husband and wife whose current inheritance liability was approximately £60,000, and they had the financial means to be able to cover this liability without significantly impacting the capital wealth being passed onto the next generation. However, from April 2027 their liability will increase to £610,000. As their wealth is mainly held in their house, investment portfolios and pensions, with the changes to the Budget, the planning options were limited for this couple.

Understanding the implications

We discussed with our client the calculations to demonstrate existing tax legislation and what the impact would be in April 2027 post the changes coming in. The goals for our client had not changed and they wanted their family members to ultimately inherit the property, Investment portfolio and SIPPS, but this was significantly jeopardised due to the significant amount of tax now needed to be paid on death.

*This assumes the current estate value remain unchanged between now and April 2027.

**Assumes no change to the Nil Rate Bands.

***Based on current legislation regarding estates (the Residence Nil Rate Band (RNRB) is reduced by £1 for every £2 that the estate value is in excess of £2 million), exact rules on whether pensions will affect the RNRB are yet to be announced.

****Assumes spousal exemptions applies, this is yet to be confirmed on pensions.

Once the implications were digested by the couple, we discussed the following;

- cashflow projections – indicating how this liability could potentially rise and escalate in the future.

- Discussed ways the tax liability could be reduced; such as by spending or making lifetime gifts. However given the age of the clients and being fully retired in their mid 50s, there was a need to ensure they retain enough capital to support themselves for the foreseeable future.

- Exploring the concept of protection and how it could cover the liability.

After discussing ways the liability could be mitigated, it was clear our clients wanted to do something but did not wish to jeopardise their current standard of living.

Our recommendations

After reviewing the options, our recommendation was to take out a whole of life policy to cover their Inheritance Tax Liability. This resulted in a whole of life policy for £610,000 being arranged. We were able to demonstrate by our cashflow calculations that this solution would be affordable throughout their lifetime, giving the level of guaranteed income they needed to maintain their cost of living and ultimately achieving their goal of passing their wealth on to their loved ones.

While a whole of life policy does not reduce the tax payable, it does ensure the tax liability is covered, allowing their beneficiaries to inherit their full estate, which is the outcome our clients were looking for.

In order for this to be effective for inheritance tax planning, the policy needs to be held under trust. This led to a further discussion with our clients to establish the most effective trust structure for their circumstances.