Author: Geoff Cooper

Head of Investment Management, Chartered Wealth Manager - Chair of the Investment Committee

View profile

Published: July 2025

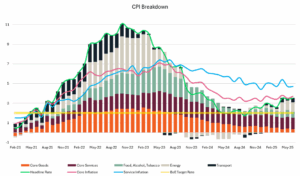

UK inflation surprised to the upside in June rising to 3.6%, its highest level since January 2024. After falling sharply over the past 18 months, this uptick caught many off guard, with forecasts expecting it to remain at 3.4%. So, what’s going on?

A mix of familiar and one-off pressures seems to be at play. Food inflation rose sharply again – up 4.5% year-on-year – driven by poor harvests and higher wage and tax costs introduced in April. Transport costs also climbed, with higher airfares and slower fuel price declines contributing to the rise. Services inflation, which is often stickier and more domestic in nature, remains elevated at 4.7%.

Source: Office for National Statistics (ONS), MM Wealth Investment Team, data as at 16/07/25.

This matters because the Bank of England (BoE) had been expected to start cutting interest rates in August. Markets are now a little less confident. Bond yields jumped on the data, reflecting concern that the BoE might have to move more cautiously. Still, with the economy showing signs of slowing – GDP dipped in May, and the labour market is softening – most economists think the Bank will stick to its plan of gradual easing, just perhaps at a slower pace.

Importantly, there are reasons to think this inflation bump could be temporary. Some of the energy and utility price hikes that lifted inflation earlier in the year will soon fall out of the data, and softer consumer spending is starting to cool demand. The BoE itself still expects inflation to fall back toward 2% over the next 12–18 months.

Meanwhile, in the US, inflation has also picked up slightly, with tariff-related costs feeding into goods prices. But core inflation remains under control, and the Fed, like the BoE, is treading carefully and waiting to see whether this is just noise or something more persistent.

What does it all mean? While June’s inflation figures are a setback, they don’t yet signal a new trend. Inflation is still far below the levels we saw in 2022, and the broader direction of travel – slower growth, cooling wages, falling energy prices – suggests further relief ahead.

Our investment strategies remain well-diversified and continue to perform robustly through these fluctuations. As always, we’re watching the data closely, but we remain cautiously optimistic that by the end of the year, inflation should be heading in the right direction again.

As ever, if you would like to discuss your investments, please do not hesitate to contact us on 01223 233331 or email info@mmwealth.co.uk.

Contact us

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments and the income from them can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance.

The information in this article is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.

The information contained within this blog is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.