Author: Gary King

Chartered Financial Planner

View profile

Cashflow modelling is used to forecast your future finances. It shows you how much money you could have in the future and whether you are on track to achieve your goals.

What benefits does cashflow modelling offer?

Cashflow modelling helps people with all kinds of different goals to find out what their finances could look like and whether they will have enough money in the future. It can help answer questions such as:

- Will I have enough money to stop working when I want to?

- How much more money do I need to save, or how much more money can I afford to spend?

- Can I afford to reduce my working hours leading up to retirement?

- How much investment risk do I need to take to achieve my goals? Can I afford to reduce or even increase my exposure to investment risk?

- If investment markets were to fall suddenly, how would this impact on my retirement plans?

- How do my savings, such as ISAs, pensions, shares, property and business assets etc.

contribute to my overall retirement income?

- How can I take an income in the most tax-efficient way possible?

- Would my family be sufficiently provided for in the event of my premature death?

- Will my family be financially stable if I go into care?

- Am I going to leave behind an Inheritance Tax (IHT) bill?

- Can I afford to make gifts to my loved ones e.g. house deposits?

As you can see, we can consider many different scenarios to see how they might affect your finances. This in turn enables us to provide you with more informed advice on how best to achieve your lifetime goals, whatever they may be.

What do you need from me?

The first step is to collect detailed information about your current finances. How much income do you receive each month? What are your outgoings? How much money have you and your partner saved in pensions, ISAs and other investment and non-investment accounts? Are you expecting to receive a future inheritance, sell a second property, or downsize from your main residence at some point in the future?

Our cashflow modelling programme will create a long-term projection of your finances using the data you provide, along with what we believe to be realistic long-term investment and economic assumptions. Our analysis will incorporate all your financial resources, take into account the various taxes you may incur and identify any potential surplus or shortfall.

The more information you provide us with in relation to your objectives and financial circumstances, the more accurate the projections will be.

Case study – will I have enough money in retirement?

Bob is a 58 year old who runs a business with his wife Susan, also aged 58. Bob and Susan ideally want to stop working at age 60 and decided to meet with their financial planner to check that they would have enough money for the retirement they wanted.

They were also keen to understand if they could afford to reduce their working hours leading up to retirement, and if more could be spent on holidays during the early stages of retirement should they wish. For peace of mind they also wanted to understand if they would have the means to meet any care home fees in the future.

Before the meeting

Before the meeting, Bob and Susan provided details of their assets, savings and liabilities – for example their pensions and investments, mortgages and business account. They also listed their current and future outgoings such as pension contributions, the regular expenses they expected for the key stages of retirement and other planned expenses, like a new car and annual holidays.

A cash flow model is prepared: –

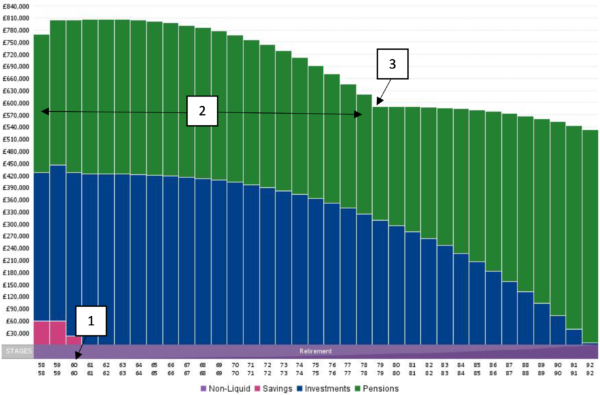

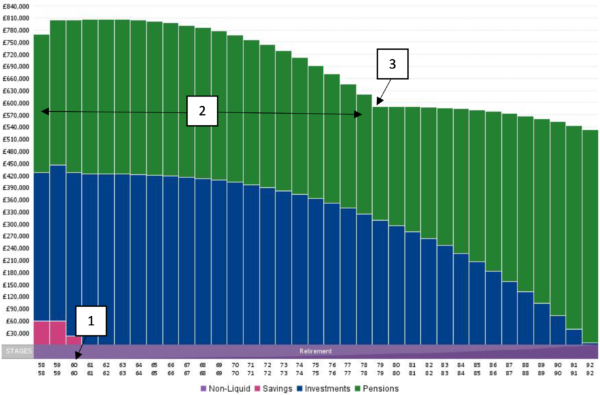

Example cash flow illustration

- Bob and Susan retire at age 60.

- The couple’s discretionary expenditure is at its highest from age 60 to age 80, as this is the

period in which they envisage spending more on holidays.

- There is a reduction in expenditure at age 80 as they expect to begin spending less.

The results of the cashflow modelling showed Bob and Susan that they had already saved more than enough money for the retirement they wanted. They could retire immediately if they desired. They could live to age 92 and still leave an inheritance to their children.

This gave Bob and Susan peace of mind that they were in a very good financial position and the contentment of knowing they could spend more during retirement. As they were forecast to leave behind assets when they died, they decided to meet again in a month’s time to discuss giving their son a cash gift to help him onto the property ladder.

The cashflow modelling also provided Bob and Susan with the reassurance that they would have access to significant capital in later life to cover potential care home fees, without them having to release capital from their property.